When running a small business it can be easy to fall into the trap of feeling like you have to do it all, which can be overwhelming for even the most seasoned business minds. But while we may be used to wearing multiple hats, the question we must ask ourselves as small business owners is… how well are we wearing those hats? For example, do you have a deep understanding of what needs to be done with regards to financial records and reporting? If you don’t have a finance background, this can be difficult to get your head around. That’s why you need a team alongside you, to help you navigate the uncertainty, put processes into place and assist you to make decisions. That team is your Finance Team.

To outsource the finance function, or keep it internal

Building a Finance Team doesn’t always mean expanding your employee head-count (cue sigh of relief). In fact, many business owners instead engage external support to fulfil this function to allow for greater flexibility, while still receiving the expert advice they desperately need within their business to meet their financial responsibilities, to comply and to grow. This approach often suits growing small businesses, as it allows them to upsize their finance team quickly when needed. In this scenario, business owners can find themselves too busy responding to increased demand on their own goods or services to acknowledge and act quickly to additional needs in the finance department.

As your business expands, you may choose to add more external professionals to your finance team, or you may hire someone internally and shift some of the roles around. When it comes to the question of outsourcing or keeping your finance function internal, there is no right or wrong answer. But what is important is that you have access (in one form or another) to this team and the expertise they bring to the table. Each person you engage, whether internal or external, should behave like any other team. That is, they work together to deliver the full finance function, ask for assistance, and keep you, the business owner, informed.

Accountants and Bookkeepers – what do they do, and who do you engage first?

Many businesses first build their finance team with either a bookkeeper or accountant. Similar to the ‘chicken and egg’ scenario, either one will come first but is typically followed by the other. Although there are typical tasks that each professional performs, their roles can somewhat overlap and this may cause confusion as to who is looking after what. It then becomes very important for you as the business owner to be clear on what each person is delivering, and what your responsibilities are.

To put it simply:

Bookkeeping is focused on the day-to-day capturing of financial records and transactions. They take raw data and enter it into software so that reports can be generated. The role is largely administrative and may include payroll, accounts receivable and accounts payable.

Accounting is focused on analysing the reports generated, adjusting for relevant tax legislation and reporting standards, and identifying how a business is performing. The role is more advisory and focused on helping business owners to make decisions.

If you’re still a little unsure of the difference between a bookkeeper and an accountant, you’re not alone. As accountants, this is a question that pops up for us time and time again as our clients start to build out their finance teams.

Distinction between the two roles is important though, as you want the right person doing the right tasks (otherwise you may be paying more than you need to). For example, an accountant will always charge a higher rate than a bookkeeper. So, if you’re asking your accountant to do any of the tasks that a bookkeeper can do, it will likely be costing your business more.

Bookkeeper and Accountant Task Comparisons

To better understand the difference between bookkeepers and accountants, it can be helpful to take a look at a comparison of tasks performed by each function.

| Bookkeeper | Accountant |

| Recording and categorising financial transactions | Preparing adjusting entries |

| Posting debits and credits | Preparing Financial Statements |

| Producing and sending invoices | Completing income tax returns |

| Maintaining and balancing bank reconciliations | Financial analysis and strategy |

| Completing payroll | Tax Strategy and tax planning |

| Recordkeeping | Financial forecasting |

To bundle accounting & bookkeeping services or to divide and conquer

Having one firm bundle bookkeeping and accounting services together for you may seem like the easiest option. However, there are advantages to having these two functions separate as well. At Lemonade Beach we focus on accounting and advisory, not bookkeeping. This allows for greater transparency of our services, and greater accountability across the board. Bundling two service offerings like accounting and bookkeeping together has its problems, as it can be harder to identify where any issues have occurred.

We are also firm believers in empowering our clients – it underpins everything we do. That’s why we support our clients bringing onboard an additional external professional to look after the books, so they can benefit from another viewpoint and an even broader finance team. As they say, there is no ‘I’ in team.

The 7 tasks to consider when building your Finance Team

Now that you have a good understanding of who belongs on your finance team, and what their responsibilities are, let’s take a closer look at some of the key tasks to consider when building out your finance function.

1. Decide who will look after the day-to-day bookkeeping (including payroll obligations)

Modern cloud software such as Xero, QBO and MYOB can appear easy to use. Whilst it’s common for business owners to choose to do the bookkeeping themselves we recommend at a minimum that you seek professional assistance to set up your file and provide some training. We also recommend that you have someone review your file on a regular basis to identify any errors being made and pass feedback to you.

Outsourced bookkeeping options may include:

- Full service Bookkeeping

- Comprehensive training

- Hybrid model where you’re trained and external bookkeeper performs a monthly or quarterly review

2. Set up systems to make collecting and processing data more efficient

Bookkeepers are awesome at this! They are used to handling vast amounts of source data and are typically great organisers. This is another reason we suggest business owners work with a well experienced bookkeeper.

3. Stay informed

It’s one thing to hand the financial data over to a bookkeeper, but it’s still your business and you need to know what’s going on. This includes knowing when compliance obligations such as superannuation payments are due. Depending on the tasks you’ve agreed with your bookkeeper, they may issue you with regular reports for the business including what is due when.

4. Determine who will be responsible for Compliance Reporting

If your business is registered for GST or has employees you’ll likely need to lodge a Business Activity Statement on a quarterly basis. Either an Accountant or a Bookkeeper can assist with this. Be clear who is going to attend to this task for you.

It’s also important to note that only a registered tax agent can prepare and lodge income tax returns.

Tip: If you’re doing your own books, BAS time is a great time to have either your bookkeeper or accountant review your data and give feedback.

5. Determine who will be responsible for Financial Reports

An accountant will prepare financial reports for your business. This involves them ensuring that you are reporting in accordance with relevant accounting standards; they consider any tax adjustments and how these should be shown in accounts; and they review your financial data to ensure accuracy.

6. Ensure you’re meeting your Tax obligations

Accountants are primarily engaged to help business owners maintain their tax obligations. This usually includes a tax return but can also include advice around structuring, tax planning and what legislation changes may mean for the business.

7. Focus on Business Improvement

The second role accountants can assist with is helping business owners to make their business better. This involves using financial reports as a base for analysis and then advising where a business owner should be focusing their efforts to optimise business performance. This often leads to scenario modelling and forecasting for better decision making. An accountant advisor may also suggest new ways of capturing data so that it can be diced and sliced into more meaningful metrics which leads to more accurate modelling and planning.

These activities are those that larger businesses employ a CFO to perform, something that is often financially out of reach for small businesses. This is a key reason that we put our Swell Program together which is a Virtual CFO (Lite) offering to introduce metrics that matter and forecasting to small businesses. As a business grows they may also wish to add management reporting and meetings to their service mix.

Bringing it all together

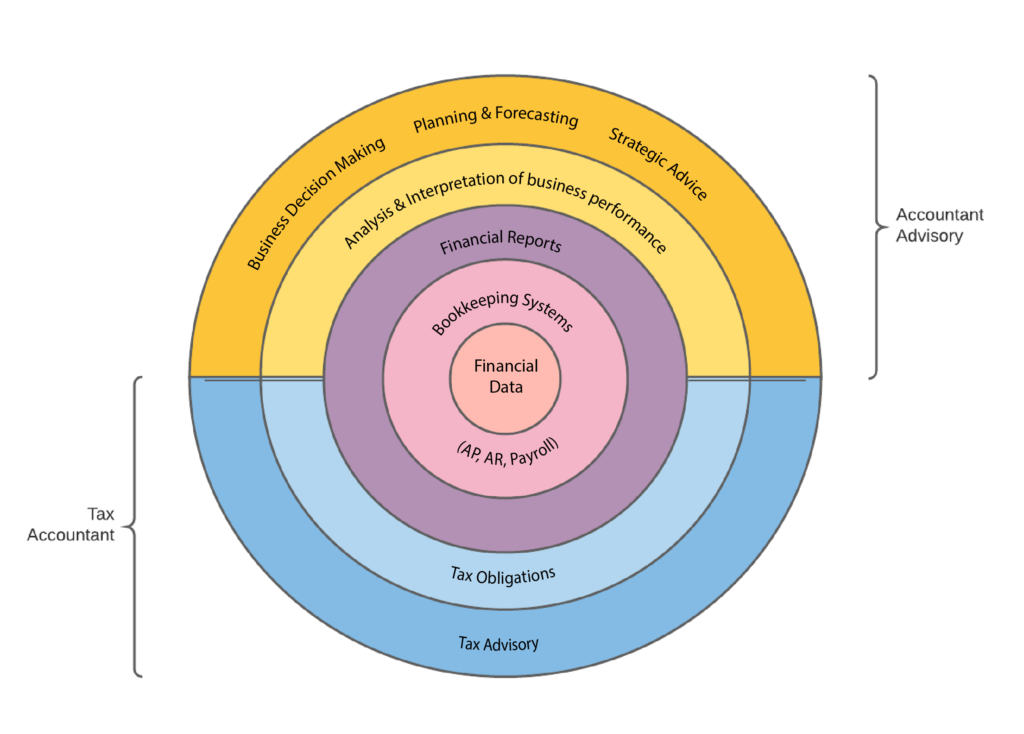

The model below further illustrates how each of the accounting and bookkeeping functions build on the last.

Central to all the finance functions is your financial data – data quality is paramount to business success, as all advice and subsequent decisions flow from that data.

Your Bookkeeper will be involved in the first two stages, maintaining data through systems to produce internal reports.

Your Accountant will be involved in the final three stages. Activities your accountant performs will depend on whether you have engaged them for tax services, advisory services or both.

As the finance function acts as a team, there should be open communication with each player working together to deliver for your business.

Photo by Matteo Vistocco on Unsplash

Our Services

To learn more about Lemonade Beach Accounting, Tax & Business Advisory Services, please follow the links below.